Each NFT has a unique digital property, which you might compare to a limited edition print of a photograph.

NFTs are deposited on a blockchain, a digital ledger, where “blocks” are representations of transactions. Each block contains transaction data, a “hash” code that identifies the block, and the hash code of the block that comes before it. Every block is connected, and if something is changed in one block, that block's code changes and invalidates the connection to other blocks down the chain. This is the kind of technology that cryptocurrencies like Bitcoin and Ether use. Estonia's e-residency program also uses a blockchain.

The difference with NFTs, compared to cryptocurrency, is that they cannot be exchanged for currency like Euros or Canadian Dollars. They are limited and cannot be replicated.

Beyond NFTs, tokens have gathered interest as a concept, including in Estonia.

“estcoin” was unveiled in December 2017 by Kaspar Korjus, managing director of the e-residency program in Estonia. At first, it was seemingly miscommunicated in the media, that it would be a national cryptocurrency, pegged to the value of the Euro and used by all Estonians. This required clarification, especially after former European Central Bank President and Italian Prime Minister Mario Draghi said that “no [European Union] member state can introduce its own currency.” Further explanation from Triin Oppi, former Media Adviser to the Estonian Government, revealed that, in fact, estcoin is meant to be a “token” for use by e-residents rather than all transactions in Estonia.

The tokens aren't as radical as they were originally anticipated to be. Yet, along with the Estonian government being enthusiastic about e-residency and secure internet voting, a government openly discussing tokens shows that Estonia is fertile ground for innovative forms of financial compensation. In October 2020, the Bank of Estonia announced that they had launched “a multi-year project… to research how technologically suitable the Estonian e-government core technology is for operating a central bank digital currency.”

There are several obstacles, at least psychological ones, that would need to be overcome for the use of tokens to become more mainstream.

Public blockchains, which Bitcoin and Ethereum (which generates Ether cryptocurrency) use, are decentralized. They can't be controlled or changed by an entity like a bank. There is concern from financial institutions and intermediaries over how public blockchains can't be regulated. It also isn't possible to track transactions back to the individuals involved, which could make criminal activity easier to get away with.

Adding data to a blockchain like that of Ethereum uses a significant amount of electricity, due to its “proof of work” cryptography system used to securely add transactions to the blockchain. The news site Vox has relayed a claim from the Institute of Electrical and Electronics Engineers that “one transaction uses more power than the average US household does in a day…” Vitalik Buterin, the inventor of Ethereum, who grew up in Toronto, has expressed that reducing energy consumption is part of the plan. Using a “proof of stake” blockchain is one possible option to consume less energy.

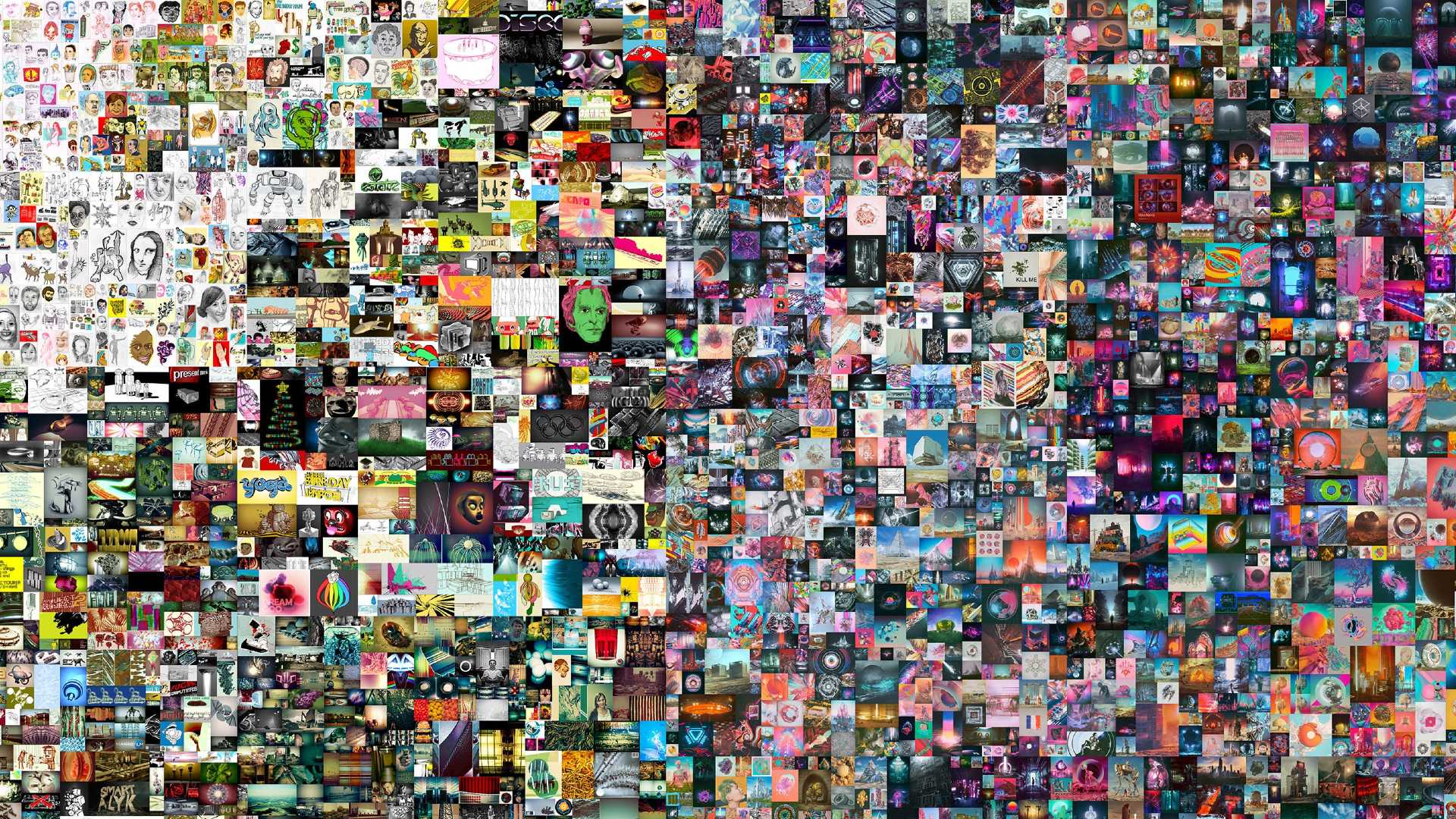

NFTs have come in the form of slam dunk clips from NBA games, as well as the latest album by Kings of Leon. There's buy-in from big names. But as an outsider to NFTs, and cryptocurrency, I'm concerned about how speculative the value of tokens and cryptocurrencies is. Few people are in the position to spend millions (or thousands) on a digital image. Even if you invested less, though, you could still incur a painful loss if the tide quickly changes and public faith in a token or cryptocurrency's value disappears.

Don't get me wrong, I think it's admirable how typically intangible goods, like digital drawings, photographs, or songs, are being held up for their value. This is value that has very much evaporated due to how small, easy to duplicate, and indistinct digital items have become. But the potential instability of that value is worrying.

And if you're worried and late to approach the technology as a result, you face something that's inaccessible and expensive. I would add, too, how confounding the information out there about tokens and cryptocurrency is. Greater clarity in education about these technologies would draw in the interest and trust of the people who could benefit most from it.

This article was written by Vincent Teetsov as part of the Local Journalism Initiative.