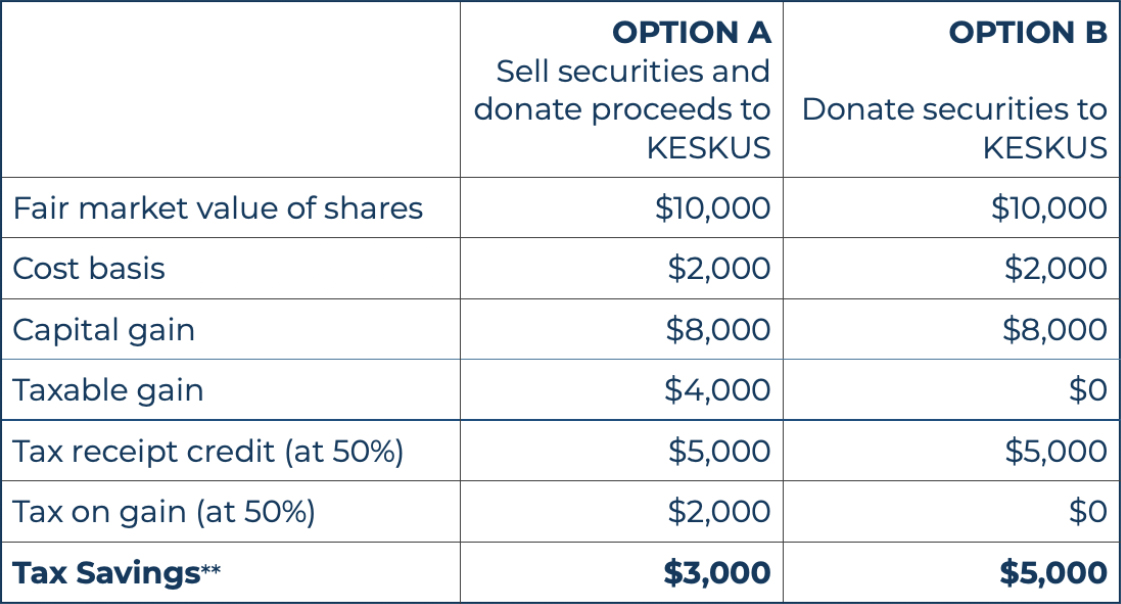

This is what it can look like, for Canadian taxpayers, for $10,000 worth of shares that have appreciated in value, donated to KESKUS*, assuming a tax rate of 50%:

With Option B, for Canadians, publicly listed securities donated directly to KESKUS* serve to eliminate the requirement to pay capital gains tax on the appreciation of those shares. Not only that, you will receive a charitable tax credit for the current value of the donated shares.

Donations of shares are also tax advantaged for U.S. donors. Donations of shares must be made to KBFUS, an organization facilitating giving to KESKUS by U.S. donors.

Philanthropy with savings: there’s no better win-win!

December 22, the deadline to initiate the transfer of securities to ensure a 2021 charitable receipt for them, is approaching fast. Donors should consult with their financial advisors to determine what's right for their particular circumstance.

To transfer shares, or to make a leadership gift, please contact Taimi Hooper, Donations Manager, at donations@estoniancentre or at +1.647.250.7136.

Signing up for the monthly newsletter will ensure that you receive the latest news on KESKUS straight to your inbox!

Get involved and help support our future

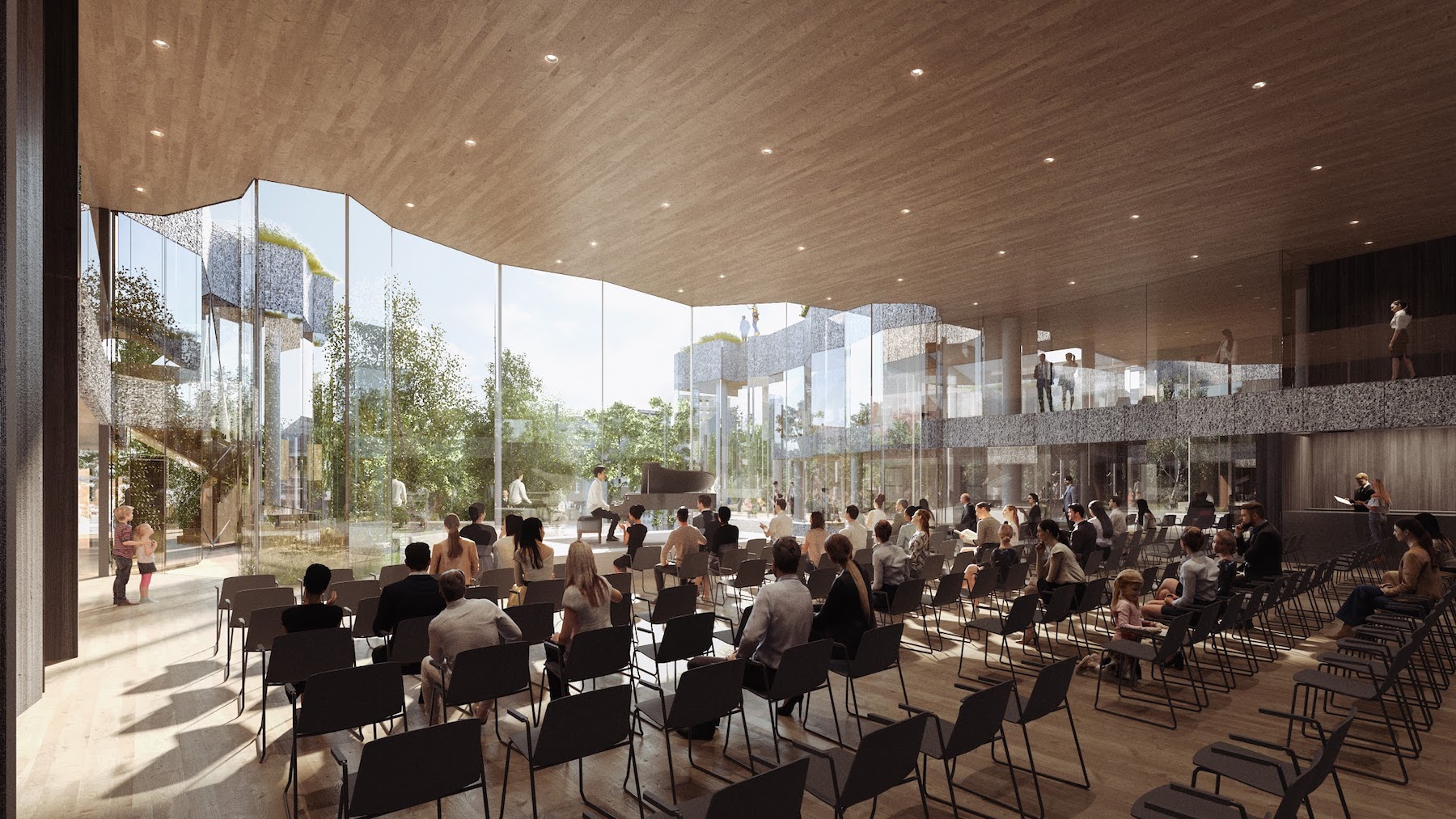

Are you interested in helping build this spectacular new home for the global Estonian community? Please join our growing list of capital campaign donors! The International Estonian Centre’s donor categories are Kalevipoja Laud for gifts over $100,000 (including naming rights for specific areas), Viru Vanemad for gifts over $10,000, and Kungla Rahvas for gifts up to $10,000. Stay tuned for the launch of the Kungla Rahvas campaign in 2021.

To make a donation, please contact Urve Tamberg at donations@estoniancentre.ca.

Donations may be made as a family gift, or in honour of an individual or family. All Canadian and U.S. donations will be issued a tax receipt.

Let's stay connected…

- Facebook: Estonian Centre (@EestiKeskus)

- Instagram @keskus.iec

- Twitter @keskus

- Eesti Elu: Look for our articles in the Eesti Elu print edition, as well as on www.eestielu.ca. All articles are also available on our website www.estoniancentre.ca.

- Sign-up for the email newsletter on www.estoniancentre.ca (bottom of our home page).