What is Socially Responsible Investing?

It is an approach to mainstream investing that works to reduce environmental, social and governance (ESG) risks. Socially Responsible Investing is about marrying traditional financial analysis with ESG analysis during investment decision-making. This marriage of the two factors creates less potential risk overall. To understand what the ESG risks entail, Jacqueline took the group through some examples.

Environmental risks are those created by business activities that have actual or potential negative impact on air, land, water and human health – including such issues as pollution and climate change.

Social risk refers to the impact that companies can have on society and addresses matters such as human rights, worker safety, and more.

Finally, governance risk is concerned with the way companies are run. It encompasses areas such as board diversity and excessive executive compensation.

SRI is more than you might think – it invests in mainstream, multinational companies based on their financial performance and ESG factors. It's more than screening for “good vs bad” companies such as producers of solar panels vs weapons. The rigorous ESG analysis adds an extra layer of risk protection for portfolios. In addition, NEI engages actively on behalf of investors, working with selected companies to help create positive change.

The Investment Process

Next, Jacqueline took us through the investment process that Ethical Funds follows.

1) They begin by assessing potential companies through traditional financial analysis. Only the best investment opportunities are considered for the portfolio.

2) Next they use their proprietary ESG analysis to identify often over-looked risks that are not reflected in financial statements.

3) The third step is creating a portfolio of these companies that fulfill both fund objectives and ESG criteria.

4) Lastly, as shareholders, Ethical Funds actively influence change through corporate engagement involving dialogue, shareholder resolutions and proxy voting.

Active Engagement

Jacqueline explained how every year, approximately 50 companies held in Ethical Funds are selected for active engagement. This engagement involves discussion, shareholder resolution and proxy voting. By becoming a shareholder in these companies, Ethical Funds has the opportunity to try and implement change. The list of companies chosen is published once a year, with quarterly updates on progress.

Socially Responsible Investing Myths

Next, Jacqueline addressed some common myths that might make people hesitant to invest in SRI funds.

Myth One: SRI is a niche and a fad. Actually, Ethical Funds have been on offer for over 25 years. SRI assets have been growing globally and are now at $US 59 trillion. SRI funds are especially popular in Europe while mainstream and growing in North America, lead by key institutional investors, including universities such as Harvard. SRI is amongst the world's fastest growing investment categories.

Myth Two: SRI limits the investment universe. In reality, all portfolio managers use some kind of process to narrow their investment universe. In the case of SRI it is environmental, social and governance analysis.

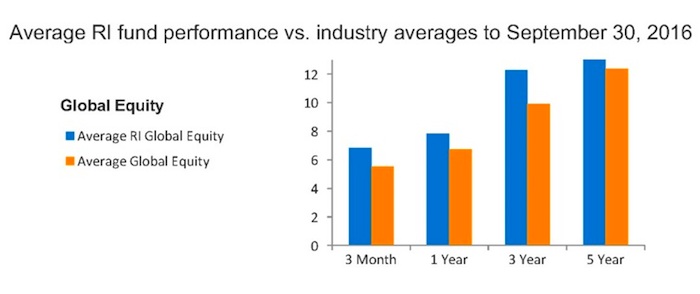

Myth Three: SRI solutions under-perform conventional funds. If you look at the graph below, you can see how this is untrue. Leading SRI Funds in Canada can and do outperform conventional funds and their benchmarks. This is a direct result of quality portfolio managers and a more in-depth ESG process. The combination of strong financial performance and rigorous ESG practices can deliver superior risk-adjusted returns over the long-term.

Term RI refers to Responsible Investments. This graph was provided by the Responsible Investment Association (RIA). They also provided similar data supporting outperformance in Canadian Equity, Canadian Neutral and Canadian Fixed Income Funds.

Questions

The night concluded with a question period where many great topics were brought forward. One question touched on the fact that Ethical Funds holds money in Coca-Cola, is this really a Socially Responsible investment? Jacqueline pointed out that all companies in Ethical Funds must meet a standard baseline, which Coca-Cola does. But at the same time, Coca Cola is one of the 50 companies, on Ethical Funds' 2016 Corporate Engagement Focus list, where the fund as shareholder is in dialogue with the company on the themes of access to nutrition and equitable compensation linked to ESG performance. It is in this way, that Ethical Funds drives positive change at large corporations.

NEI Investments is 50% owned by Canadian credit unions (and 50% owned by Desjardins, Canada's largest financial cooperative), making it a great partner for ECU and our members. Here at ECU we offer many Responsible Investing options through Credential Asset Management. To hear more about Socially Responsible Investing and how it can be a part of your investment portfolio, contact Heili Orav or Liisi Lainelo in branch today. They're here to help you make money, and make a difference.

(416) 465-4659

heilio@estoniancu.com

liisil@estoniancu.com